12 Aug AFG Stock Price American Financial Group Inc Stock Quote U.S.: NYSE

Contents:

The Hanover Insurance Group’s recent dividend hike reflects its intention to enhance shareholders’ value, supported by a strong financial position. Provide specific products and services to you, such as portfolio management or data aggregation. The technique has proven to be very useful for finding positive surprises.

Analysts give Revance Therapeutics, Inc. (NASDAQ:RVNC) a … – Best Stocks

Analysts give Revance Therapeutics, Inc. (NASDAQ:RVNC) a ….

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

American Financial Group has received a consensus rating of Hold. The company’s average rating score is 2.33, and is based on 1 buy rating, 2 hold ratings, and no sell ratings. Erie Indemnity’s recent dividend hike reflects its solid capital position and balance sheet strength that continue to support effective capital deployment. Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and mo… Niche focus on low-to-medium hazard risk small businesses, better pricing, investment in technology, solid capital position and effective capital deployment poise Employers Holdings for growth.

Want more portfolio diversification? Try different weights, not different assets

Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. 3 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for American Financial Group in the last year. There are currently 2 hold ratings and 1 buy rating for the stock.

Property and casualty firms should have the capacity to pay out the estimated claims from Sandy; we’re leaving our fair value estimates unchanged. There may be delays, omissions, or inaccuracies in the Information. The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank. First Republic Bank is in trouble, and all market participants await today’s earnings to learn the extent of the bank’s challenges. The stock is down 87% since the regional banking turmoil began in March.

Analyst Ratings

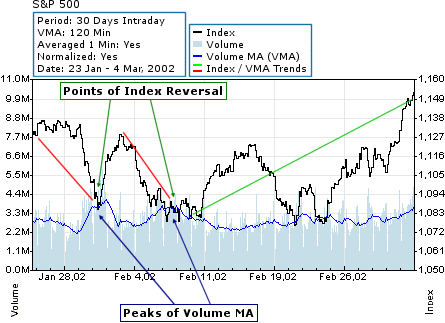

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year. These returns cover a period from January 1, 1988 through April 3, 2023.

Its Property and Casualty Insurance Products include Property and Transportation, Specialty Casualty, and Specialty Financial. The company was founded by Carl Henry Lindner Jr. in 1959 and is headquartered in Cincinnati, OH. American Financial Group Inc is a holding company that is engaged primarily in property and casualty insurance services.

The consensus among Wall Street equities research analysts is that investors should “hold” AFG shares. A hold rating indicates that analysts believe investors should maintain any existing positions they have in AFG, but not buy additional shares or sell existing shares. Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions.

Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. A valuation method that multiplies the price of a company’s stock by the total number of outstanding shares. Real-time analyst ratings, insider transactions, earnings data, and more.

Sales & Book Value

Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. American Financial Group saw a increase in short interest in April. As of April 15th, there was short interest totaling 951,500 shares, an increase of 6.3% from the March 31st total of 895,500 shares.

- 14.60% of the stock of American Financial Group is held by insiders.

- These products and services are usually sold through license agreements or subscriptions.

- A compelling portfolio, strong renewal retention, positive rate increases, strategic initiatives to fuel profitability and solid capital position continue to drive Chubb .

- They rarely distribute dividends to shareholders, opting for reinvestment in their businesses.

64.04% of the stock of American Financial Group is held by institutions. High institutional ownership can be a signal of strong market trust in this company. American Financial Group pays a meaningful dividend of 2.07%, higher than the bottom 25% of all stocks that pay dividends. American Financial Group has a short interest ratio (“days to cover”) of 2.6, which is generally considered an acceptable ratio of short interest to trading volume.

Price Target and Rating

American Financial Group declared a quarterly dividend on Monday, April 3rd. Shareholders of record on Friday, April 14th will be paid a dividend of $0.63 per share on Tuesday, April 25th. This represents a $2.52 dividend on an annualized basis and a yield of 2.05%. The ex-dividend date of this dividend is Thursday, April 13th. Unum is well poised to gain from higher sales, higher persistency, improving premium income and prudent capital deployment.

Our Quantitative Research team models direct competitors or comparable companies from a bottom-up perspective to find companies describing their business in a similar fashion. The industry with the best average Zacks Rank would be considered the top industry , which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. Take your analysis to the next level with our full suite of features, known and used by millions throughout the trading world.

Value investors frequently look for companies that have low price/book ratios. Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. Cigna Corp.’s CI first-quarter earnings fell 85% as costs to exit the run-off reinsurance business and other items masked the managed-care company’s revenue growth. Shares of National Interstate Corp. surged 3.7% in premarket trade Wednesday, after American Financial Group Inc. raised its buyout bid for the Ohio-based insurance holding company by 6.7% to $32 a share. AXIS Capital remains poised to grow on increases in lines of business, new business growth, continued strong retentions, accelerated digitalization and prudent capital deployment.

Stock tips from Obama and Romney

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. Measures how much net income or profit is generated as a percentage of revenue. The company is scheduled to release its next quarterly earnings announcement on Tuesday, May 2nd 2023.

Based on an average trading volume of 372,200 shares, the days-to-cover ratio is currently 2.6 days. Price/book ratio can tell investors approximately how much they’re paying for a company’s assets, based on historical, rather than current, valuations. Historical valuations generally do not reflect a company’s current market value.

© 2023 https://1investing.in/ data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. By creating a free account, you agree to our terms of service. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Forward P/E gives some indication of how cheap or expensive a stock is compared with consensus earnings estimates. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated. Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season.

The Hanover Insurance Group Inc

Segmental strength, a full employment and favorable growth estimates poise Everest Re well for growth. RLI stands to gain from compelling product portfolio, sustained rate increase, expanded distribution, operational strength and sufficient liquidity. SAN FRANCISCO — Qantas Airways said it will hold a press conference Thursday morning, Sydney-time, amid reports that it has accepted a sweetened $8.7 billion all-cash takeover offer from a consortium led by … CompareAFG’s historical performanceagainst its industry peers and the overall market. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market.

- Represents the company’s profit divided by the outstanding shares of its common stock.

- American Financial Group, Inc., an insurance holding company, provides specialty property and casualty insurance products in the United States.

- We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view.

- Style is calculated by combining value and growth scores, which are first individually calculated.

- W.R. Berkley is poised to benefit from higher premiums, growing underwriting profits, reductions in loss ratio and effective capital deployment.

- Forward P/E gives some indication of how cheap or expensive a stock is compared with consensus earnings estimates.

The PEAD projected a bullish outlook for $AFG after a positive over reaction following its earnings release placing the stock in drift B with an expected accuracy of 50%. According to 3 analysts, the average rating for AFG stock is “Hold.” The 12-month stock price forecast is $158.33, which is an increase of 29.01% from the latest price. A compelling portfolio, strong renewal retention, positive rate increases, strategic initiatives to fuel profitability and solid capital position continue to drive Chubb . Price/sales represents the amount an investor is willing to pay for a dollar generated from a particular company’s sales or revenues.

This Insider Has Just Sold Shares In Australian Finance Group Limited (ASX:AFG) – Simply Wall St

This Insider Has Just Sold Shares In Australian Finance Group Limited (ASX:AFG).

Posted: Wed, 14 Dec 2022 08:00:00 GMT [source]

Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards. Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

American Financial Group, Inc., an insurance holding company, provides specialty property and casualty insurance products in the United States. The company sells its property and casualty insurance products through independent insurance agents and brokers. American Financial Group, Inc. was founded in 1872 and is headquartered in Cincinnati, Ohio.

No Comments